Which game categories in the App Store have the greatest volume of non-branded traffic

ASOdesk studied the volume of branded and non-branded traffic in 16 game categories for Russia, the United States, Spain, Germany, and France. This data will help you choose a category for a new game or a strategy for promoting an existing app. The study is based on ASOdesk’s report at the WN Conference 2021.

In the app stores, many users search for mobile games by brand. For example, App Store users in the US are more likely to search for “Call of Duty” (a branded query) than “shooter” (a non-branded query). This complicates App Store Optimization and publishers’ entry into the market because newcomers have to compete with strong brands. And after the introduction of auto-correction in the App Store in 2020, it became even more difficult to use branded queries with an error for App Store Optimization.

We studied the volume of branded and non-branded traffic in different categories of games:

1. We have compiled a semantic core for 16 categories in 5 countries: the United States, Russia, Germany, France, and Spain. We divided the search queries into branded and non-branded queries and worked out the percentage ratio of these two groups. The diagram shows the volume of non-branded traffic in descending order by country and category.

2. We looked at the increase in ASA Popularity for 2020 compared to 2019. This is an official indicator that helps you evaluate the popularity of search queries inside Search Ads in the App Store.

This article will help you find new niches or choose a strategy to promote your game. In ASOdesk’s October study you’ll also find the percentage of organic and non-organic traffic for different apps and games.

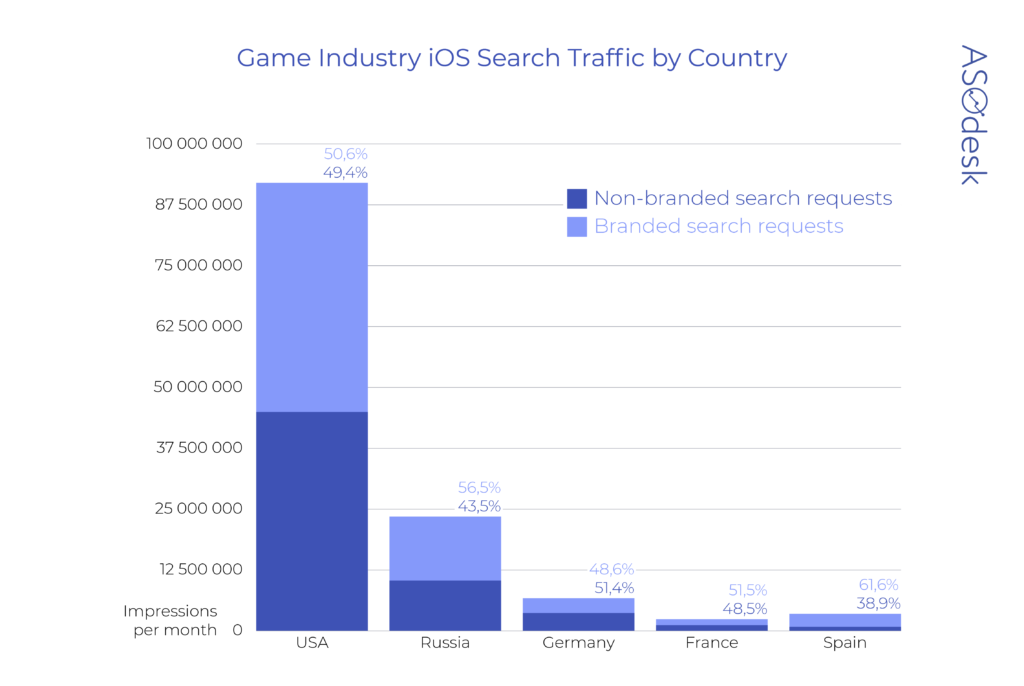

Overall study of five countries

To compare the ratio of branded and non-branded traffic in different countries, we will analyze monthly impressions for all categories of games in the United States, Russia, Germany, France, and Spain.

On the vertical axis is the average number of impressions by country in January 2021, calculated using Daily Impressions in ASOdesk.

We see that the US has the largest volume of non-branded traffic — about 45 million requests. In other countries, the total number of impressions per month is much less.

In the US, Germany, and France, the percentage of branded and non-branded search traffic is roughly the same. Branded search queries are more common in Russia (about 57%) and Spain (about 62%).

Let’s look at the volume and proportions of branded and non-branded traffic in 16 app categories for each country.

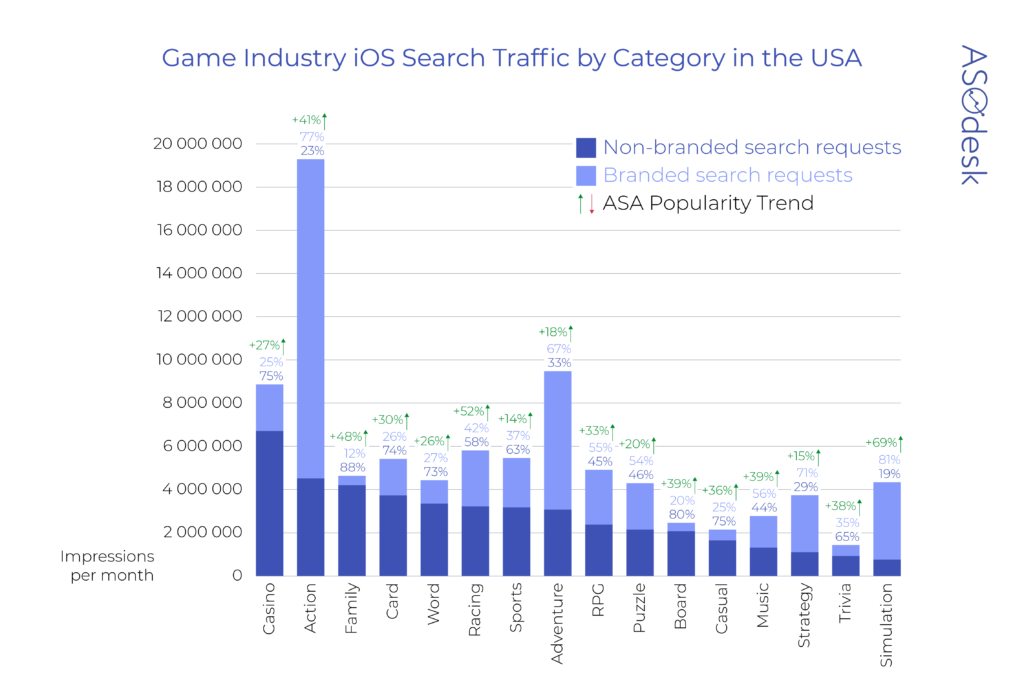

The US

In the US, the most popular game categories are action (almost 20 million impressions per month) and adventure (about 10 million impressions).

The ASA Popularity index (a measure of the popularity of requests in the App Store) increased by more than 40% in the categories action, family, racing, and simulators.

Pay attention to the growing popularity of games in all categories. This trend can be traced not only in the United States, but also in Germany, France, and Spain. In many ways, the growth of user activity in the mobile market was due to the coronavirus.

There were more than 3 million impressions for non-branded queries in the categories casino, family, card, word, racing, sports. More than 58% of the traffic in these categories comes from non-branded queries.

These games are most suitable for App Store Optimization. However, when choosing a category and strategy to promote a game, study the competitors in your niche. In addition to high demand, there may also be high competition in the category, which will make promotion more difficult.

Branded queries are mostly found in the categories action, adventure, strategy, and simulation. However, action and adventure games also have a large volume of non-branded traffic — more than 3 million requests. To get downloads from search in such games, you need to invest in the development of the game’s brand.

For search promotion in these categories, you should use low-frequency queries that are not related to the brand. For example, the long-tail query “action games for free”, which gets 105 impressions per day. You can check impressions per day for search requests from your niche using the Keyword Explorer tool and Daily Impressions metric in ASOdesk.

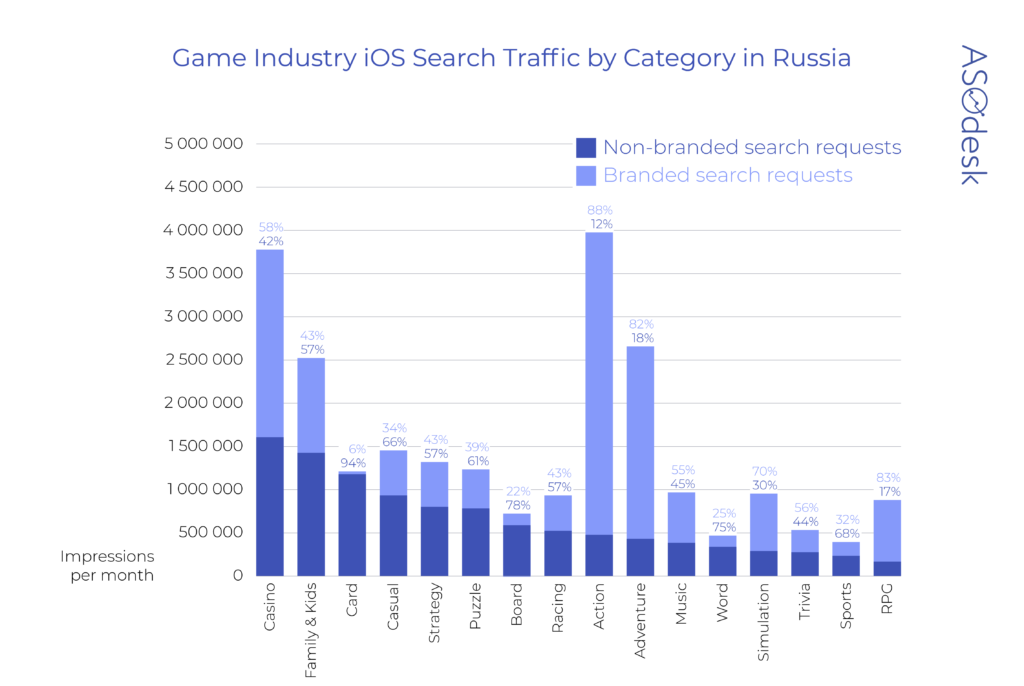

Russia

The analysis of search queries shows that in Russia, the majority of gaming applications are dominated by branded search traffic. Most often, users search for games in the action and casino categories.

In the categories family & kids, card, casual, strategy, puzzle, more than 57% of requests are non-branded, with more than 700,000 impressions. Pay attention to casino games. In terms of the percentage of non-branded traffic, they have less, but this category leads in the number of non-branded requests (about 1.58 million). Games in these categories are suitable for promotion through the App Store.

Action, adventure, RPG, and simulation-games will have to compete with strong rivals in the search since these categories have more than 70% of branded queries.

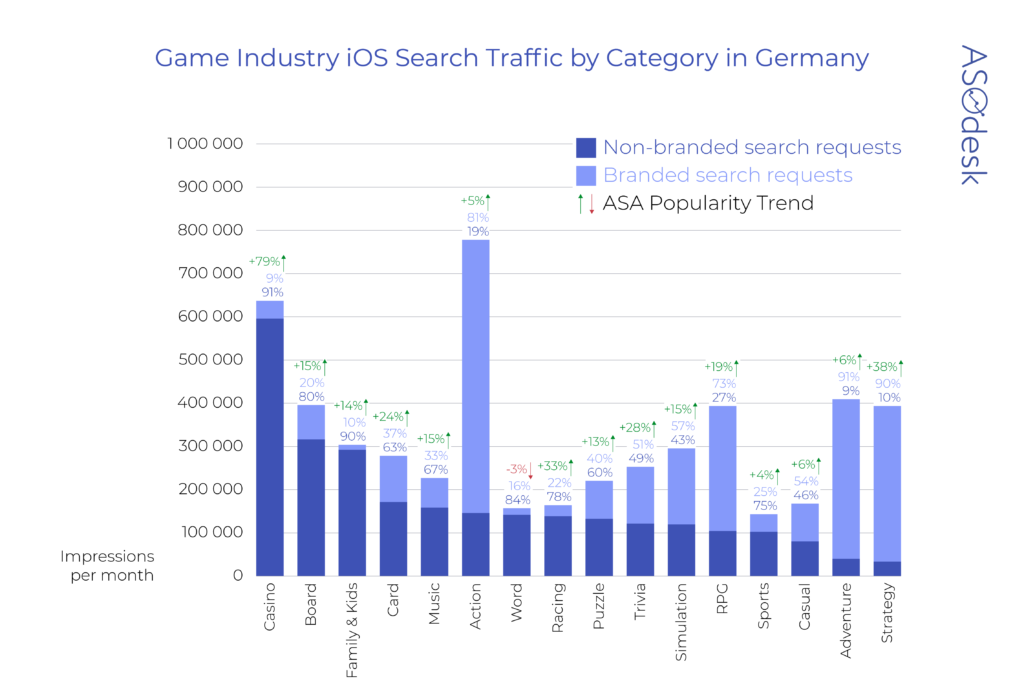

Germany

We see an interesting trend in the growing popularity of queries in Germany. In 2020, the ASA Popularity of casino games grew by 79%. A growth of 24% is also seen with games in the card, racing, trivia, and strategy categories. The popularity of the word category decreased slightly, by 3%.

If in Russia branded traffic prevails, then in Germany, on the contrary, there is more non-branded traffic.

More than 59% of non-brand requests are in the categories casino, board, family & kids, card, music, word, racing, and puzzle. Each of these categories is shown in the search from 130,000 times per month or more, which means that it will be easier to start search promotion in them.

More than 60% of branded traffic is found in action, RPG, adventure, and strategy games. It will be harder to get ahead in the search for the publishers of such apps.

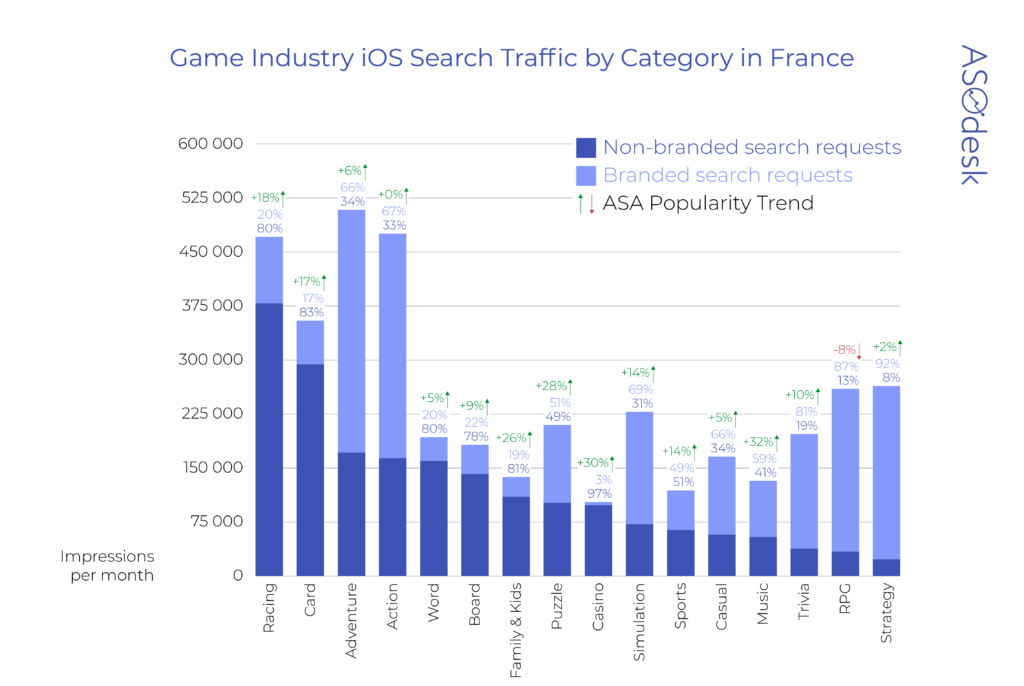

France

In France, the ASA Popularity Trend index for the categories family & kids, puzzle, and casino increased by 26-30%. The popularity of the RPG category decreased by 8%.

More than 60% of non-branded traffic is in the categories racing, card, word, board, family & kids, and casino. For non-branded queries, these games are shown in the search more than 100,000 times. Racing games are in the lead, with almost 400,000 impressions.

Branded requests prevail in adventure, action, simulation, trivia, RPG, strategy games. Note that the adventure and action categories also have a large volume of non-branded traffic, with more than 150,000 impressions. This means that App Store Optimization of such applications can be successful if you select non-branded and low-frequency queries.

Spain

In Spain, action games are popular, with almost 600,000 impressions per month. There is a noticeable increase in the popularity of queries by 20-30% in the board, sports, simulation, puzzle, card, and strategy categories.

Available niches for promotion in the search board, racing, family & kids, sport, and word. These niches have more than 55% of all non-branded queries that are searched for more than 50,000 times a month.

Branded requests are most common in action, casino, puzzle, adventure, trivia, RPG, music, and strategy games.

Conclusions

1. In the countries we looked at, App Store users mostly search for games in the action category. Only in France do these games have a slightly lower volume of search traffic when compared to the adventure category.

2. If you want to launch a new game, pay attention to the family category — non-branded requests in this category start from 55% in the USA, Russia, Germany, France, and Spain.

We also see 55% of non-branded queries in the card and word categories in 4 countries and in the racing and board categories in 3 countries. In all the countries we analyzed, these categories occupy one of the leading positions in the number of non-branded queries.

It will be easier for gaming apps in these categories to advance in the App Store, as they will not have to compete with strong brands. Your game will be able to receive impressions for general search queries.

3. To promote games in the categories action, adventure, strategy, and simulation, App Store Optimization will not be enough. Branded traffic here makes up more than 60% of overall traffic in 4–5 of the countries we analyzed . However, in the US and Germany, action and adventure games have quite a large number of impressions for non-branded queries, which makes it easier to promote them in the App Store.

If you promote games in these categories, don’t expect quick results, it will take time for users to remember a new brand. Be prepared to invest in the development of social networking, advertising, working with bloggers, and other marketing channels that will increase the awareness of your game. Read more detailed recommendations for choosing an app promotion strategy in the ASOdesk Organic Traffic Study.