ASOdesk Index Germany Apps: Brand and Non-Brand Searches

One of the ASO manager’s objectives is looking for keyword searches that can significantly boost an app’s visibility in search listing. This requires the analysis of relevant keyword searches and identification of those of them that have traffic in countries the product is distributed in.

We have conducted a research at ASOdesk using our Keyword Explorer Tool and Competitors & Keyword Charts tools and have collected a core of popular App Store and Google Play searches in Germany. We have divided all the popular searches into two groups: brand and non-brand.

In this article we are going to show significant differences in queries made by users from the selected country in various categories and will answer the question about “How do German users search for the necessary applications?”

Applications: Brand Searches

For data calculation we used Traffic Score – the indicator that defines the amount users per day by a particular search query.

The analysis showed that brand searches performed by Google Play and App Store users in Germany are more popular, than the searches of general nature. This means that users more often look for applications that they’ve already heard of. These statistics have been proven previously, as well. According to TUNE that has studied the most popular App Store search queries, 9 out of 10 top search queries are brand names.

App Store

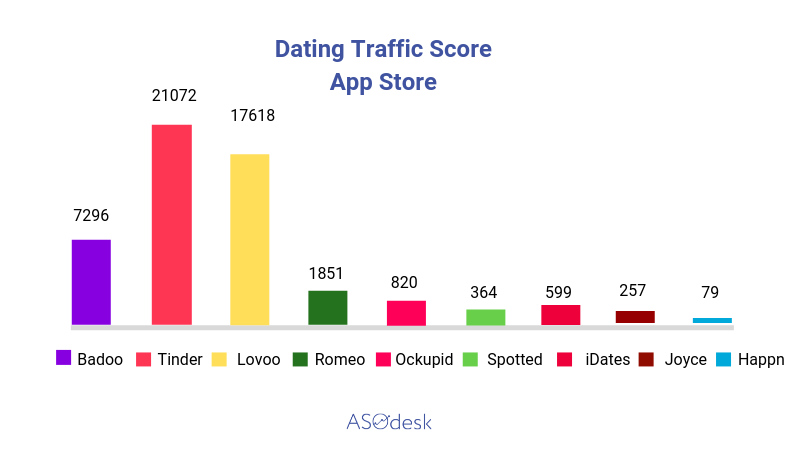

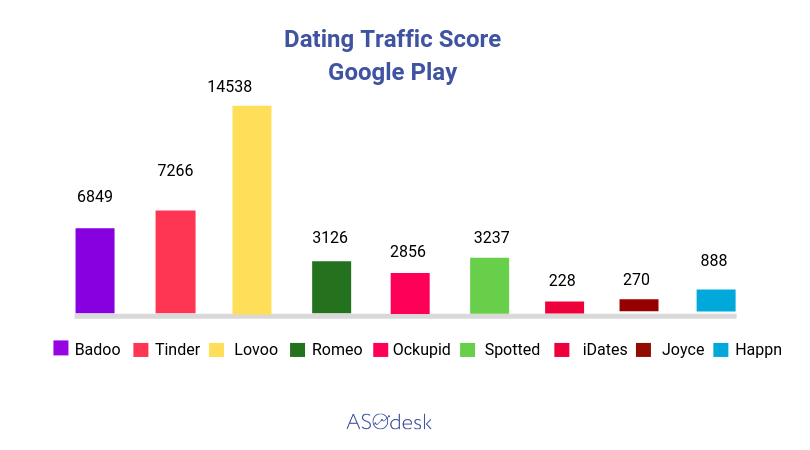

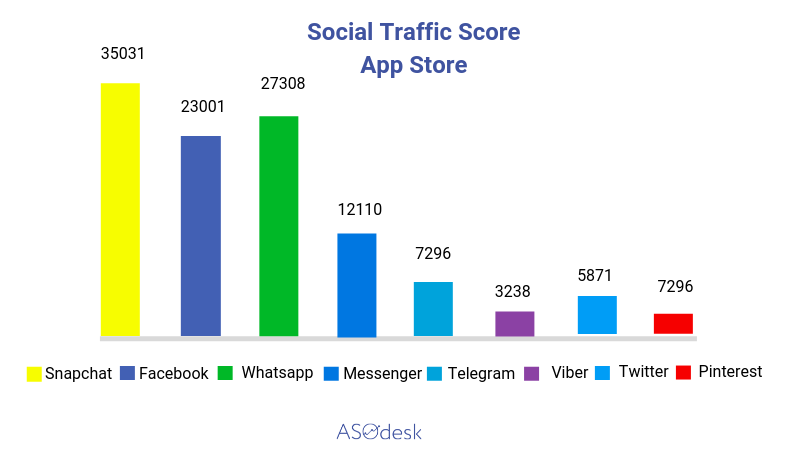

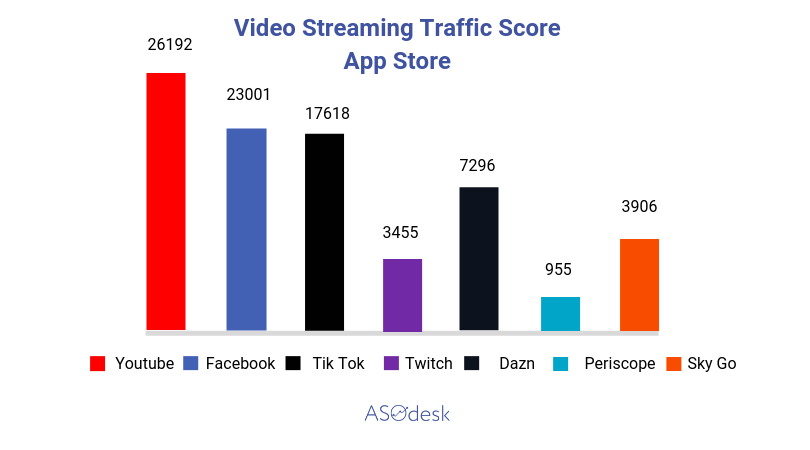

The analysis showed that German App Store users prefer apps from such queries, as Social, Dating, and Streaming. These sections’ queries have a high total traffic volume by brand searches.

- Tinder — 21072 Traffic Score

- Snapchat — 35031 Traffic Score

- YouTube — 26192 Traffic Score

Let’s compare the most popular keyword searches from the Dating category by traffic volume in both markets, where each query is accompanied by a daily number of users per query:

Search Index for most popular keywords from category Social on the App Store:

Search Index for most popular keywords from category Video streaming on the App Store:

Remember that brand searches can’t be used in textual metadata. But, if you have enough budget, you can try to launch an ad campaign target them using the Apple Search Ads tool that is available in Germany and get higher in the search listing position. But of course, be careful with targeting on competitors, it is maybe tricky and expensive.

Also, understanding which brands are more popular and their metadata analysis can help you find the right keyword searches for your app.

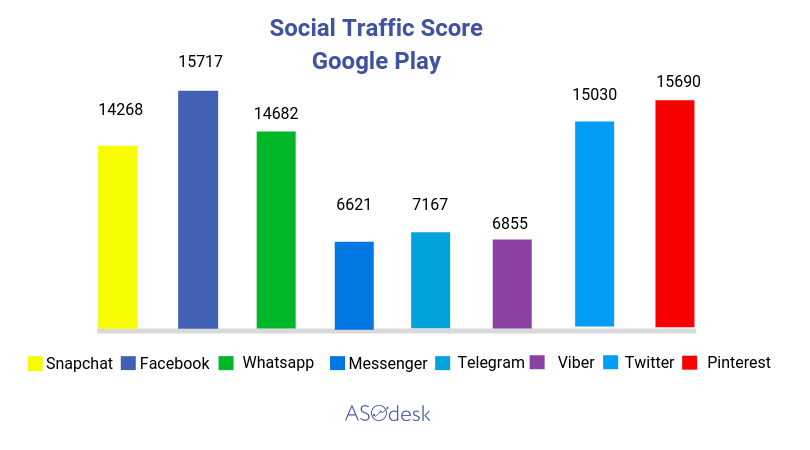

Google Play

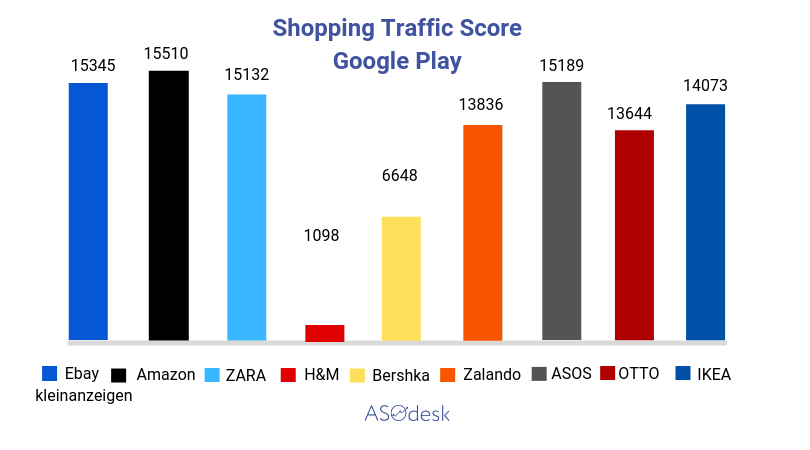

Google Play users mostly search within Shopping, Social, and Video Streaming categories, whose overall daily user amount by the most popular queries makes the following:

- Online Shopping —117210 Traffic Score

- Social — 102726 Traffic Score

- Streaming — 80926 Traffic Score

It has to be noted that some brand names are adapted to the German audience. For example, the popular Ebay online store translated the app name to German, which reads as “Ebay kleinanzeigen.”

In the Social category, Facebook outpaced its competitors

- Facebook — 15717 Traffic Score

Twitch app showed the highest results in the Video Streaming category:

- Twitch — 15861 Traffic Score

Travel category can also boost of huge traffic. Traffic Score in the examples provided below shows the amount of traffic by the most popular brand searches in the niche – Airbnb, Blablacar, Skyscanner, Booking, Wizz Air, Uber:

- Booking — 2886 Traffic Score

- Wizz Air— 1566 Traffic Score

- Uber — 3114 Traffic Score

- Skyscanner — 6786 Traffic Score

- Airbnb — 15747 Traffic Score

- Blablacar — 7602 Traffic Score

The analysis shows that a large amount of search traffic accounts for the world’s largest brands, with whom it’s rather difficult to compete. This is why we recommend checking the general keyword searches and paying attention to the wrong spelling of brand searches or composite queries associated with big brands. Remember that you can’t use trademarks in your metadata.

Applications: General Searches

App Store

App Store users encounter a different situation, when it comes to general searches. The most popular keywords are those that are associated with such categories, as Photo, Dating, and Travel. Most popular in each category are:

- Foto bearbeiten (photo editor in German) — 3455 Traffic Score

- Sky ticket — 3455 Traffic Score

- Dating apps — 1994 Traffic Score

General keyword search data in both application stores in the Dating category in Germany are quite revealing, as well. As you can see, users are searching both in English and German languages:

| Keyword | App Store | GP |

| dating | 1110 | 2688 |

| dating apps | 1994 | 3243 |

| daten | 55 | 1134 |

| flirt app | 215 | 3267 |

| meet me | 1110 | 774 |

| love | 702 | 2739 |

| dates | 39 | 30 |

| leute treffen | 20 | 228 |

| chatten | 69 | 57 |

| gay chat | 65 | 2877 |

| leute kennenlernen | 63 | 993 |

| love app | 47 | 900 |

The last place in popular App Store searches in Germany is taken by the Video Streaming category with a total popular search traffic of 931. But, with a competent optimization, one can achieve good results even in this category by using point queries in German. For example, “streamen,” “live fernsehen,” etc. Always analyze market suggestions. Comprehension of how real users are looking for applications will provide you with the more precise data for semantic core creation.

Comparison table of the most popular searches in the Video Streaming category on the App Store and Google Play:

| Keyword | App Store | Google Play |

| streaming | 63 | 36 |

| live stream | 61 | 3180 |

| streamen | 23 | 33 |

| online | 83 | 2805 |

| tv app live fernsehen | 33 | 33 |

| nero streaming player | 408 | 921 |

| live streaming | 25 | 36 |

| musik streaming | 33 | 1194 |

| online multiplayer | 36 | 42 |

| live fernsehen | 14 | 978 |

| tv live stream | 53 | 3084 |

| stream | 77 | 3099 |

| streaming for iphone | 22 | 0 |

Searches associated with “Taxi” query show a surprisingly low popularity with just 702 Traffic Score on the German App Store. Considering this category’s popularity in other countries, you shouldn’t ignore this niche, but you must thoroughly analyze the related local searches. Upon a thorough analysis and relevant choice of words with a sufficient traffic amount, you can get good results.

Comparison table of the most traffic-intensive queries related to taxis in both stores:

| Keyword | App Store | Google Play |

| taxi | 702 | 3219 |

| taxi app | 364 | 933 |

| fahrer app | 27 | 0 |

| taxi eu | 65 | 1047 |

| taxi berlin | 59 | 2778 |

| taxi simulator | 101 | 1077 |

Google Play

Top brand searches among Google Play users include search queries related to the Travel category, such as Hotels, Avia, as well as Delivery, Photo, and Social:

- Hotels — 15543 Traffic Score

- Billigflüge — 7137 Traffic Score

- Essen und Trinken — 7356 Traffic Score

- Photo editor — 6921 Traffic Score

- Chat — 7551 Traffic Score

Just as with the App Store, you should note the popularity of German-language queries in almost all categories. For example, using the “günstige flüge” keyword (“cheap flights” in German) with 7236 Traffic Score or the “foto bearbeiten” query (“edit a photo” in German) with 3455 Traffic Score can bring more traffic to an application, if they are hit in the top of a search listing.

If your application belongs to one of these categories, you can use these keyword searches and phrase combinations to increase visibility on Google Play. Don’t forget that the amount of traffic isn’t constant, so make sure to follow data updates.

The Delivery category query picture is quite interesting: the amount of traffic is higher on Google Play; users are using queries both in English and German languages. The following table includes the most popular queries from the Delivery category on Google Play and App Store and shows the amount of traffic for each query:

| Keyword | App Store | Google Play |

| Delivery | 37 | 2994 |

| Food | 257 | 3282 |

| Sushi | 69 | 3027 |

| Food delivery | 21 | 252 |

| Lebensmittel | 61 | 2805 |

| Lieferung | 33 | 33 |

| Essen Bestellen | 77 | 2658 |

| Essen | 257 | 7077 |

| Essen und Trinken | 73 | 7356 |

| Burger | 79 | 3006 |

| Lieferdienst | 42 | 42 |

| Lieferservice | 83 | 3105 |

Approach semantic core creation thoroughly, use keyword searches both in English and German languages, watch local players in this niche and consider local specificities. You can use our Keyword Explorer Tool or another analogous ASO tool based on app stores’ search data for semantic core creation.

Let’s Summarize

German App Store and Google Play users search for brands more frequently. Most of the traffic is concluded in brand searches in both markets.

App Store audience prefers dating apps, social networks, and video streaming services – we have registered the most popular brand searches with the highest traffic amount in these categories. In general searches, App Store users mostly look for tools related to photo editing, applications for traveling and dating, social networks, and messengers.

Google Play audience in Germany actively introduces brands from Shopping, Social, and Video-Streaming categories into the search. General searches are led by keywords in Travel, Social and Delivery categories.

Recommendations

We’ve assembled a somewhat small list of recommendations for those, who is planning to release onto the German market or wants to improve the indices of an already existing product in this country’s applications stores:

- Thoroughly study top competitors in the German market, which popular searches they use in their metadata and by which queries they take first places;

- When creating a semantic core, use queries both in English and German languages;

- To improve product’s visibility on the App Store, try launching ad campaigns in Apple Search Ads, using popular brands from your niche;

- Don’t ignore niches with low search queries’ amount indices;

- Use popular queries of general nature for games and applications;

- Include point queries in German into the semantic core;

- Expand the core on the App Store at the expense of additional locales. You can always check the list of countries and localizations in our table at Localizations

If you are interested in the ASO Index in other countries, send us a message and we will conduct an analysis of keyword searches in this country!